Nearly all the early information on how it worked addressed employees and payroll. I first discovered Womply because they were one of the first to put out some clear information on how the Paycheck Protection Program works for independent contractors. They help businesses and sole proprietors find a lender that can handle their applications. Womply is a registered agent in the SBA program that works with several lenders. Womply introduced the Fast Lane application to make it fast and easy for independent contractors and individuals to apply. Yet the same application is often used for both. The program works very differently for those of us who are independent contractors than it does for businesses with multiple employees. Unfortunately, the applications can be confusing. Income earned from Doordas, Uber Eats, Instacart, Grubhub, Lyft, Postmates, Shipt, GoPuff, Roadie or any of the many other gig economy apps is meant to be protected by this program.

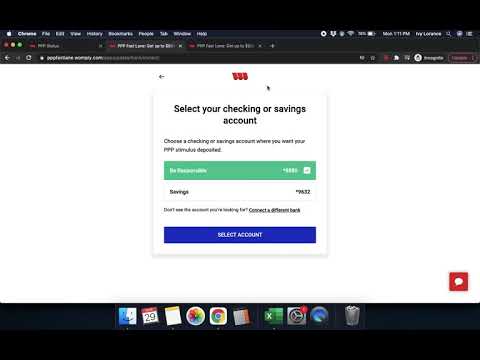

In this program, the government sees your earnings as your paycheck. However, the intent of the PPP is very clear: Independent contractors, gig workers, and other self employed individuals ARE eligible for the fully forgivable Paycheck Protection Program stimulus funding. They think that it means this is only meant for businesses that have a payroll. Part of the confusion for a lot of gig workers and other sole proprietors is the “Paycheck” in the Paycheck Protection Program. Don't get hung up on the Paycheck part of the PPP. We'll take a look at the Fast Lane application and how it simplifies the application process. Womply has created a fast, easy way to apply for PPP funding as a self employed contractor. We are grateful to partners like Womply who are helping us ensure our clients are on a Fast Lane to PPP funding and to driving economic recovery.The Paycheck Protection Program application can be overwhelming and confusing for an independent contractor with gig economy apps like Doordash, Uber Eats, Instacart, Grubhub, Lyft and others. They are entrepreneurs of colour creating assets and jobs, residents of rural communities keeping their Main Street alive, immigrants pursuing a cherished dream of being in business, and so many more. “Our clients are real people whose businesses shape neighbourhoods and communities. “DreamSpring is dedicated to accelerating access to much-needed capital for small business owners and to amplifying economic inclusion in everything we do,” said DreamSpring Chief Impact Officer, Marisa Barrera. Immediately after completing PPP Fast Lane, applicants will be matched with their SBA approved lender. Borrowers don’t need a registered business entity, business licence, official place of business, business bank account, accountant, lawyer or business banker to apply for PPP. PPP Fast Lane includes multiple layers of fraud prevention and identity verification, which is essential to serving PPP loans at scale in accordance with government rules. PPP Fast Lane is a simple, web-based data collection process aiming to simplify the PPP process by removing friction that only applies to larger businesses. These eligible borrowers, which include micro businesses, gig-workers, independent contractors, among others, are frequently found in low-and-middle income and minority communities, making program access all the more important.

PPP Fast Lane was built to service under-served eligible businesses (and workers) that have so far had difficulty accessing the Paycheck Protection Program. DreamSpring joins Womply’s PPP Fast Lane program, which enables the smallest businesses to access vital Paycheck Protection Program (PPP) funding with as little friction as possible, while helping borrowers remain compliant and minimising program fraud. Womply, a local commerce platform that provides apps, APIs, marketing and financial tools to more than 500,000 small businesses, has announced an integrated partnership with DreamSpring, a non-profit lender serving entrepreneurs and small businesses.

0 kommentar(er)

0 kommentar(er)